How Much Money Can I Make Per Year Student Loan Repayment

Educatee Loan Calculator

College is supposed to be fun, right? Hollywood sure thinks so: in movies like One-time School, Legally Blonde and Accepted, it'south one-half wild parties, half intellectual and emotional discovery. But that'due south Hollywood—the schools themselves pigment a different, only equally attractive picture. Open any admissions part pamphlet and you'll find students lounging cheerfully in grassy campus spaces; friendly, outgoing professors chatting with small clusters of doting undergrads; clean, peaceful dormitories; and constantly perfect atmospheric condition.

While both of these portrayals comprise some truth (there are parties; the weather is nice sometimes), there'southward one aspect of college that is oftentimes left out, or at least pushed to the sidelines: the price tag. While information technology'south no undercover that getting a degree has grown more expensive in recent years, the numbers are still surprising. The cost of tuition and fees at public four year institutions increased by 17% over the past 5 years alone, according to data from The Higher Lath.

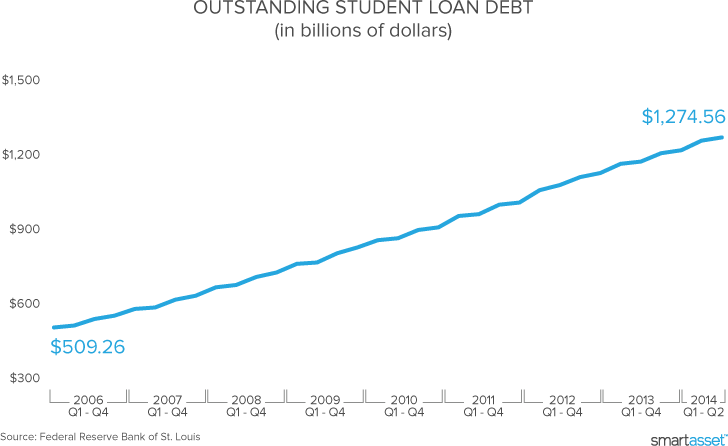

For many students, the only way to stay atop this rising tide has been by taking on an increasing amount of student loans. The effect has been skyrocketing student loan debt over the past decade.

Not then fun, that – but don't get discouraged. Certain, some recent graduates accept educatee loan horror-stories to tell: high debt, low chore prospects and a load of other expenses to boot; and others take simply stopped bothering to make loan payments at all (the full number of people with defaulted educatee loans recently climbed to over 7 million). Many graduates, withal, find their debt to be manageable, and, in the long run, worthwhile.

The of import thing is to know in advance what yous're getting yourself into. By looking at a pupil loan calculator, y'all can compare the costs of going to different schools. Variables like your marital status, age and how long yous volition be attending (likely four years if you are inbound as a freshman, two years if you are transferring as a junior, etc.) go into the equation. Then with some financial information like how much y'all (or your family) volition be able to contribute each year and what scholarships or gifts you've already secured, the educatee loan payment calculator tin can tell you what amount of debt you can wait to take on and what your costs will exist afterward you graduate – both on a monthly ground and over the lifetime of your loans. Of form how much you will pay will besides depend on what kind of loans you cull to take out.

Here to help

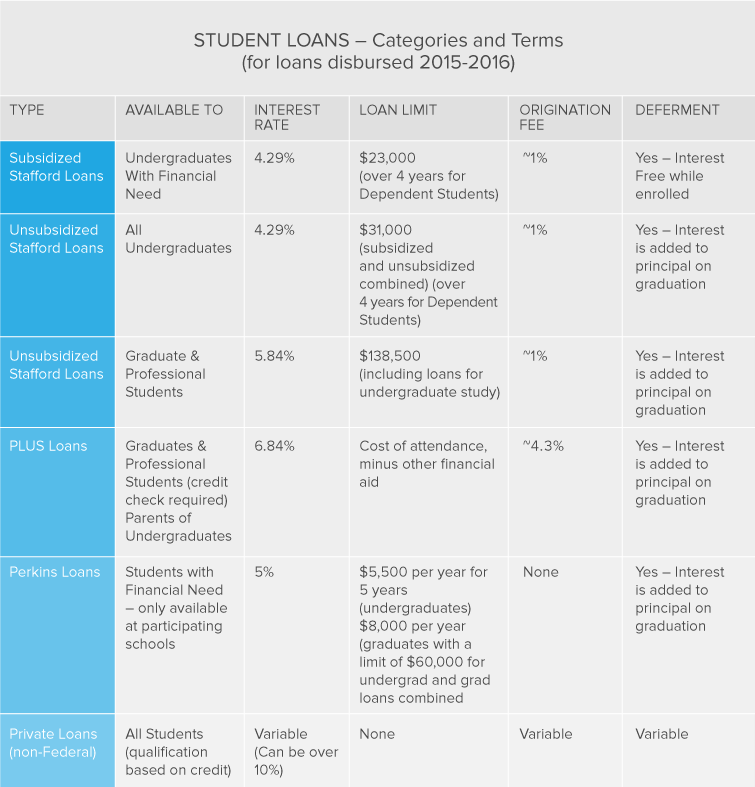

The federal government has a number of different educatee loan programs, described beneath, that offer low interest rates and other student-friendly terms. If yous are able to use whatsoever of these programs to pay for part of your college tuition, your debt after graduation may be easier to manage.

Different loans for different folks

Earlier getting into the different types of available loan programs, let's do a quick refresher on how exactly student loans work. Like any type of loan (auto loan, credit card, mortgage), pupil loans cost some small amount to have out (an origination fee) and they require interest and principal payments thereafter. Principal payments go toward paying back what you lot've borrowed, and involvement payments consist of some agreed upon percent of the amount you still owe. Typically, if you miss payments, the involvement yous would take had to pay is added to your total debt.

In the U.S.A., the federal government helps students pay for higher past offering a number of loan programs with more favorable terms than nigh private loan options. Federal student loans are unique in that, while y'all are a student, your payments are deferred—that is, put off until later on. Some types of Federal loans are "subsidized" and practise not accumulate interest payments during this deferment catamenia.

Stafford loans

Stafford loans are the federal government's master student loan option for undergraduates. They offering a low origination fee (about 1% of the loan), the everyman involvement rates possible (four.29% for the 2015-2016 academic year), and unlike auto loans or other forms of debt, the interest rate does not depend on the borrower's credit score or income. Every student who receives a Stafford loan pays the same rate.

There are two different types of Stafford loans: subsidized and unsubsidized. Subsidized Stafford loans are available only to students with financial need. As long every bit you are in school, and for a six month "grace period" following graduation, you do non take to pay interest on subsidized loans, equally the federal regime takes care of that for y'all. All told, subsidized Stafford loans are the best student loan deal available, simply eligible undergraduate students tin can just take out a full of $23,000 in subsidized loans, and no more $3,500 their freshman year, $four,500 their sophomore yr and $v,500 junior year and beyond.

For students who are ineligible to receive subsidized loans, unsubsidized Stafford loans are available. These offer the same low interest rate equally subsidized loans, but without the authorities-funded interest payments. That ways that interest accumulates while you are in school, and is then added the amount y'all have to pay back (as well known as your principal balance) once y'all graduate. While this may sound similar a small-scale difference, it can add together upwards to hundreds or thousands of dollars of debt beyond what you borrowed. A adept student loan repayment calculator takes into business relationship the difference between subsidized and unsubsidized loans.

Along with the specific ceiling of $23,000 for subsidized Stafford loans, in that location is a limit on the cumulative total of unsubsidized and subsidized combined that any one student tin take out. Undergraduate students who are dependent on their parents for financial support can take out a maximum of $31,000 in Stafford loans and students who are financially independent can accept out up to $57,500 in Stafford loans. Then, for a student who has already maxed out her corporeality of subsidized loans, she could take out an additional $8,000 to $34,500 in unsubsidized loans, depending on whether or non she is a dependent.

Graduate and professional person students can no longer get subsidized loans. Since 2012, they are only eligible for unsubsidized options. They can accept out $20,500 each year for a full of $138,500. It's important to note that this full includes loans that were taken out for undergraduate study also.

PLUS loans

For graduate and professional students, the federal government offers a separate option, called PLUS Loans. In that location is no borrowing limit for PLUS loans—they can be used to pay the full cost of attendance, minus any other fiscal aid received, however they have a higher interest rate and origination fee than Stafford Loans (equally of 2015, the involvement charge per unit for PLUS loans is 6.84% and the origination fee is well-nigh iv.3%). They besides crave a credit check, so students with bad credit may not exist eligible. PLUS loans can besides be used by parents of undergraduate students to aid pay for a son or girl's education.

Perkins Loans

Perkins Loans are another class of depression-interest (5% in 2015) federal loan, but unlike Stafford and PLUS loans, they are offered directly through your college or academy. They are available merely to students with fiscal need, and only at schools that participate in the program—to notice out if this is you, check with your school's financial help office.

At schools that do participate, eligible undergraduates tin can borrow up to $5,500 per yr and $27,500 full in Perkins loans; and eligible graduate students can borrow up to $8,000 per year and $60,000 total. Only proceed in mind that funds for Perkins loans are limited, and so in exercise those ceilings may exist lower at sure schools.

Private loans

Once all federal loan options have been exhausted, students can turn to individual loans for whatsoever remaining funding. Private loans generally offer far less favorable terms than federal loans, and can be harder to obtain. They tin can take variable interest rates, often higher than 10%. The interest rate, and your ability to receive individual pupil loans, can depend on your credit record. While some do provide for the deferment of payments while you are in school, many practice non. Private loans exercise not brand sense for everybody, but for some students they can be helpful to bridge the gap between federal loans and the cost of college.

Applying for federal financial aid

Photo credit: © iStock/Sadeugra

The process for obtaining federal financial assist is relatively piece of cake. Yous make full out a single grade, the Free Awarding for Federal Student Assist (FAFSA) and send it to your schoolhouse's financial aid function. Then they do the rest. The FAFSA is your single gateway to Stafford loans, Perkins loans and PLUS loans. Many colleges also utilise it to decide your eligibility for scholarships and other options offered past your state or schoolhouse, and then y'all could authorize for even more financial aid.

There is really no reason not to complete a FAFSA. Many students believe they won't qualify for financial aid because their parents brand besides much money, but in reality the formula to decide eligibility considers many factors besides income. Past the same token, grades and age are non considered in determining eligibility for most types of federal financial help, then yous won't be disqualified on account of a depression GPA.

At what cost?

If you think you'll be using 1 or more of these loan programs to pay for higher, it's a proficient thought to determine alee of fourth dimension approximately what your payments will be later on yous graduate. A student loan calculator can help. The size of your monthly payments will vary depending on what types of fiscal aid you are eligible for and what school y'all attend. Although toll should not exist the master factor any student considers when deciding where to go to school, it could be ane of several considerations, especially if y'all will need to use student loans to pay your tuition. Y'all don't want to miss out on enjoying your college experience because you're worried well-nigh debt. Higher is supposed to be fun, isn't it?

Source: https://smartasset.com/student-loans/student-loan-calculator

Posted by: yoderhadegre.blogspot.com

0 Response to "How Much Money Can I Make Per Year Student Loan Repayment"

Post a Comment