Who Do Banks Loan Most Of Their Money To

Chapter 27. Money and Cyberbanking

27.3 The Role of Banks

Learning Objectives

Past the end of this section, yous will exist able to:

- Explain how banks human activity as intermediaries betwixt savers and borrowers

- Evaluate the relationship between banks, savings and loans, and credit unions

- Analyze the causes of bankruptcy and recessions

The late bank robber named Willie Sutton was once asked why he robbed banks. He answered: "That'due south where the money is." While this may have been true at one time, from the perspective of modern economists, Sutton is both right and wrong. He is incorrect because the overwhelming majority of coin in the economic system is not in the course of currency sitting in vaults or drawers at banks, waiting for a robber to appear. Most money is in the form of bank accounts, which exist only every bit electronic records on computers. From a broader perspective, however, the bank robber was more correct than he may take known. Banking is intimately interconnected with coin and consequently, with the broader economy.

Banks make information technology far easier for a complex economy to bear out the extraordinary range of transactions that occur in goods, labor, and financial uppercase markets. Imagine for a moment what the economic system would exist like if all payments had to be made in cash. When shopping for a large purchase or going on vacation yous might need to conduct hundreds of dollars in a pocket or purse. Even pocket-size businesses would demand stockpiles of cash to pay workers and to buy supplies. A depository financial institution allows people and businesses to store this money in either a checking business relationship or savings account, for case, and then withdraw this money as needed through the use of a straight withdrawal, writing a check, or using a debit carte.

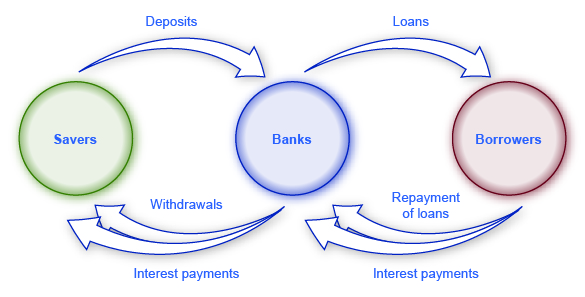

Banks are a critical intermediary in what is called the payment system, which helps an economy exchange goods and services for coin or other financial assets. As well, those with extra money that they would like to salve can store their coin in a bank rather than expect for an individual that is willing to borrow information technology from them and and so repay them at a later engagement. Those who desire to infringe money can go directly to a banking company rather than trying to find someone to lend them cash Transaction costs are the costs associated with finding a lender or a borrower for this money. Thus, banks lower transactions costs and act equally financial intermediaries—they bring savers and borrowers together. Along with making transactions much safer and easier, banks also play a key office in the creation of money.

Banks every bit Fiscal Intermediaries

An "intermediary" is one who stands between ii other parties. Banks are a fiscal intermediary—that is, an institution that operates between a saver who deposits money in a bank and a borrower who receives a loan from that depository financial institution. Financial intermediaries include other institutions in the fiscal market such as insurance companies and pension funds, but they will not exist included in this discussion because they are not considered to exist depository institutions, which are institutions that have money deposits and then utilize these to brand loans. All the funds deposited are mingled in one big pool, which is and then loaned out. Figure 1 illustrates the position of banks as fiscal intermediaries, with deposits flowing into a depository financial institution and loans flowing out. Of course, when banks make loans to firms, the banks will try to funnel financial capital letter to healthy businesses that have good prospects for repaying the loans, non to firms that are suffering losses and may exist unable to repay.

How are banks, savings and loans, and credit unions related?

Banks have a couple of close cousins: savings institutions and credit unions. Banks, every bit explained, receive deposits from individuals and businesses and make loans with the money.

Savings institutions are also sometimes called "savings and loans" or "thrifts." They also take loans and make deposits. All the same, from the 1930s until the 1980s, federal law limited how much involvement savings institutions were allowed to pay to depositors. They were also required to make most of their loans in the course of housing-related loans, either to homebuyers or to real-manor developers and builders.

A credit spousal relationship is a nonprofit financial institution that its members own and run. Members of each credit union decide who is eligible to be a member. Ordinarily, potential members would be everyone in a certain customs, or groups of employees, or members of a certain organization. The credit marriage accepts deposits from members and focuses on making loans dorsum to its members. While in that location are more credit unions than banks and more banks than savings and loans, the full avails of credit unions are growing.

In 2008, there were vii,085 banks. Due to the bank failures of 2007–2009 and bank mergers, at that place were five,571 banks in the United States at the cease of the fourth quarter in 2014. According to the Credit Union National Association, as of Dec 2014 there were 6,535 credit unions with avails totaling $one.1 billion. A day of "Transfer Your Money" took place in 2009 out of general public disgust with large banking company bailouts. People were encouraged to transfer their deposits to credit unions. This has grown into the ongoing Movement Your Coin Project. Consequently, some now hold deposits as large as $l billion. Withal, as of 2013, the 12 largest banks (0.2%) controlled 69 percent of all banking assets, according to the Dallas Federal Reserve.

A Bank's Balance Sheet

A balance canvas is an accounting tool that lists avails and liabilities. An asset is something of value that is owned and can be used to produce something. For case, the cash you own can be used to pay your tuition. If you own a home, this is also considered an asset. A liability is a debt or something you lot owe. Many people borrow money to buy homes. In this instance, a home is the nugget, simply the mortgage is the liability. The net worth is the asset value minus how much is owed (the liability). A bank's residual canvass operates in much the same way. A banking company'south net worth is also referred to as depository financial institution upper-case letter. A banking concern has assets such as greenbacks held in its vaults, monies that the banking concern holds at the Federal Reserve bank (called "reserves"), loans that are made to customers, and bonds.

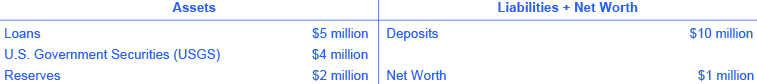

Figure two illustrates a hypothetical and simplified remainder canvass for the Safe and Secure Bank. Because of the two-column format of the residue sheet, with the T-shape formed by the vertical line down the eye and the horizontal line under "Assets" and "Liabilities," it is sometimes called a T-business relationship.

The "T" in a T-account separates the assets of a firm, on the left, from its liabilities, on the correct. All firms employ T-accounts, though almost are much more complex. For a depository financial institution, the assets are the fiscal instruments that either the banking company is holding (its reserves) or those instruments where other parties owe money to the bank—similar loans made by the banking company and U.S. Government Securities, such as U.S. treasury bonds purchased by the banking concern. Liabilities are what the bank owes to others. Specifically, the depository financial institution owes whatsoever deposits fabricated in the bank to those who have made them. The cyberspace worth of the banking company is the total assets minus total liabilities. Net worth is included on the liabilities side to have the T account balance to zero. For a healthy business, net worth will exist positive. For a bankrupt firm, internet worth will be negative. In either example, on a depository financial institution's T-business relationship, assets will ever equal liabilities plus internet worth.

When banking company customers deposit money into a checking account, savings business relationship, or a certificate of eolith, the bank views these deposits as liabilities. After all, the bank owes these deposits to its customers, when the customers wish to withdraw their money. In the example shown in Figure two, the Safety and Secure Bank holds $10 million in deposits.

Loans are the first category of banking company avails shown in Figure 2. Say that a family unit takes out a 30-year mortgage loan to purchase a house, which means that the borrower will repay the loan over the next thirty years. This loan is clearly an asset from the bank'southward perspective, considering the borrower has a legal obligation to make payments to the depository financial institution over fourth dimension. Only in practical terms, how can the value of the mortgage loan that is being paid over xxx years be measured in the nowadays? One way of measuring the value of something—whether a loan or anything else—is by estimating what another party in the market is willing to pay for it. Many banks issue home loans, and charge diverse treatment and processing fees for doing and then, but then sell the loans to other banks or financial institutions who collect the loan payments. The market where loans are fabricated to borrowers is called the main loan market, while the market in which these loans are bought and sold by financial institutions is the secondary loan marketplace.

One key factor that affects what financial institutions are willing to pay for a loan, when they buy it in the secondary loan market place, is the perceived riskiness of the loan: that is, given the characteristics of the borrower, such as income level and whether the local economic system is performing strongly, what proportion of loans of this blazon will exist repaid? The greater the risk that a loan will non be repaid, the less that any financial institution will pay to acquire the loan. Another key factor is to compare the involvement charge per unit charged on the original loan with the current interest rate in the economy. If the original loan made at some point in the past requires the borrower to pay a low interest rate, but current involvement rates are relatively high, then a financial establishment will pay less to acquire the loan. In contrast, if the original loan requires the borrower to pay a high interest charge per unit, while current interest rates are relatively low, and then a fiscal institution volition pay more to larn the loan. For the Safe and Secure Bank in this example, the total value of its loans if they were sold to other financial institutions in the secondary market is $5 million.

The second category of banking company asset is bonds, which are a common machinery for borrowing, used by the federal and local government, and likewise private companies, and nonprofit organizations. A bank takes some of the coin it has received in deposits and uses the money to purchase bonds—typically bonds issued by the U.S. government. Government bonds are low-take a chance considering the regime is about certain to pay off the bond, albeit at a low rate of interest. These bonds are an asset for banks in the same way that loans are an asset: The depository financial institution will receive a stream of payments in the future. In our example, the Prophylactic and Secure Bank holds bonds worth a total value of $4 million.

The final entry nether avails is reserves, which is money that the bank keeps on manus, and that is not loaned out or invested in bonds—and thus does not lead to interest payments. The Federal Reserve requires that banks keep a certain percentage of depositors' money on "reserve," which means either in their vaults or kept at the Federal Reserve Banking concern. This is called a reserve requirement. (Monetary Policy and Bank Regulation will explicate how the level of these required reserves are 1 policy tool that governments accept to influence bank behavior.) Additionally, banks may too want to continue a sure amount of reserves on hand in backlog of what is required. The Condom and Secure Bank is holding $2 1000000 in reserves.

The net worth of a bank is defined as its full avails minus its total liabilities. For the Safe and Secure Bank shown in Effigy 2, net worth is equal to $1 one thousand thousand; that is, $11 million in assets minus $10 million in liabilities. For a financially healthy banking concern, the net worth will be positive. If a bank has negative net worth and depositors tried to withdraw their money, the banking company would non be able to give all depositors their coin.

For some physical examples of what banks practise, scout this video from Paul Solman'southward "Making Sense of Financial News."

How Banks Go Bankrupt

A banking company that is broke volition take a negative net worth, meaning its assets will exist worth less than its liabilities. How tin this happen? Again, looking at the balance canvas helps to explicate.

A well-run bank will assume that a small pct of borrowers will non repay their loans on fourth dimension, or at all, and factor these missing payments into its planning. Retrieve, the calculations of the expenses of banks every year includes a factor for loans that are not repaid, and the value of a depository financial institution's loans on its balance sheet assumes a certain level of riskiness because some loans volition not be repaid. Fifty-fifty if a banking concern expects a certain number of loan defaults, it will suffer if the number of loan defaults is much greater than expected, as can happen during a recession. For example, if the Prophylactic and Secure Bank in Effigy 2 experienced a wave of unexpected defaults, so that its loans declined in value from $5 1000000 to $3 1000000, then the assets of the Safe and Secure Bank would decline then that the bank had negative net worth.

What led to the fiscal crisis of 2008–2009?

Many banks make mortgage loans so that people tin can buy a domicile, but then do not keep the loans on their books as an asset. Instead, the depository financial institution sells the loan. These loans are "securitized," which means that they are bundled together into a fiscal security that is sold to investors. Investors in these mortgage-backed securities receive a charge per unit of render based on the level of payments that people make on all the mortgages that stand behind the security.

Securitization offers certain advantages. If a bank makes well-nigh of its loans in a local area, so the bank may exist financially vulnerable if the local economy declines, then that many people are unable to brand their payments. Simply if a banking concern sells its local loans, and so buys a mortgage-backed security based on dwelling loans in many parts of the country, it can avoid being exposed to local fiscal risks. (In the unproblematic example in the text, banks just own "bonds." In reality, banks can own a number of fiscal instruments, as long equally these financial investments are safe enough to satisfy the government bank regulators.) From the standpoint of a local homebuyer, securitization offers the benefit that a local banking concern does not need to take lots of actress funds to make a loan, because the bank is only planning to concur that loan for a short time, before selling the loan then that it can be pooled into a financial security.

Simply securitization also offers one potentially large disadvantage. If a bank is going to hold a mortgage loan as an asset, the bank has an incentive to scrutinize the borrower carefully to ensure that the loan is likely to be repaid. However, a bank that is going to sell the loan may be less careful in making the loan in the showtime place. The bank will be more willing to make what are called "subprime loans," which are loans that accept characteristics like depression or zero down-payment, niggling scrutiny of whether the borrower has a reliable income, and sometimes depression payments for the offset year or two that will be followed by much higher payments after that. Some subprime loans made in the mid-2000s were later dubbed NINJA loans: loans made even though the borrower had demonstrated No Income, No Chore, or Assets.

These subprime loans were typically sold and turned into financial securities—only with a twist. The thought was that if losses occurred on these mortgage-backed securities, sure investors would concur to take the first, say, 5% of such losses. Other investors would concur to take, say, the next five% of losses. By this approach, all the same other investors would not need to have whatsoever losses unless these mortgage-backed financial securities lost 25% or xxx% or more of their full value. These complex securities, along with other economical factors, encouraged a large expansion of subprime loans in the mid-2000s.

The economic stage was now set for a banking crisis. Banks idea they were buying only ultra-rubber securities, considering fifty-fifty though the securities were ultimately backed by risky subprime mortgages, the banks but invested in the role of those securities where they were protected from modest or moderate levels of losses. But as housing prices fell subsequently 2007, and the deepening recession made information technology harder for many people to make their mortgage payments, many banks plant that their mortgage-backed financial assets could end up existence worth much less than they had expected—and so the banks were staring bankruptcy in the face up. In the 2008–2011 period, 318 banks failed in the United States.

The take chances of an unexpectedly loftier level of loan defaults can be especially difficult for banks because a bank'southward liabilities, namely the deposits of its customers, can exist withdrawn speedily, only many of the bank's avails similar loans and bonds will simply be repaid over years or fifty-fifty decades.This asset-liability fourth dimension mismatch—a bank'due south liabilities can be withdrawn in the short term while its assets are repaid in the long term—can cause severe problems for a banking concern. For example, imagine a bank that has loaned a substantial amount of money at a certain involvement charge per unit, but then sees involvement rates rise essentially. The bank tin find itself in a precarious situation. If information technology does not raise the interest rate information technology pays to depositors, then deposits volition period to other institutions that offering the higher interest rates that are now prevailing. Withal, if the bank raises the interest rates that it pays to depositors, information technology may stop up in a situation where it is paying a higher interest rate to depositors than it is collecting from those past loans that were fabricated at lower involvement rates. Clearly, the bank cannot survive in the long term if it is paying out more in interest to depositors than information technology is receiving from borrowers.

How can banks protect themselves against an unexpectedly high rate of loan defaults and confronting the risk of an nugget-liability time mismatch? Ane strategy is for a bank to diversify its loans, which means lending to a diverseness of customers. For instance, suppose a bank specialized in lending to a niche market—say, making a high proportion of its loans to construction companies that build offices in one downtown area. If that one area suffers an unexpected economic downturn, the banking company will endure large losses. However, if a bank loans both to consumers who are buying homes and cars and also to a wide range of firms in many industries and geographic areas, the banking company is less exposed to risk. When a bank diversifies its loans, those categories of borrowers who take an unexpectedly big number of defaults will tend to be balanced out, according to random take a chance, by other borrowers who have an unexpectedly low number of defaults. Thus, diversification of loans tin help banks to keep a positive net worth. However, if a widespread recession occurs that touches many industries and geographic areas, diversification will not assist.

Along with diversifying their loans, banks take several other strategies to reduce the chance of an unexpectedly big number of loan defaults. For example, banks tin can sell some of the loans they make in the secondary loan market, as described earlier, and instead hold a greater share of assets in the form of authorities bonds or reserves. Nevertheless, in a lengthy recession, most banks will see their net worth decline because a college share of loans volition not be repaid in tough economic times.

Key Concepts and Summary

Banks facilitate the use of money for transactions in the economic system considering people and firms can use banking concern accounts when selling or buying goods and services, when paying a worker or existence paid, and when saving money or receiving a loan. In the fiscal capital letter market, banks are fiscal intermediaries; that is, they operate between savers who supply financial capital and borrowers who demand loans. A balance sail (sometimes called a T-account) is an accounting tool which lists assets in one column and liabilities in some other column. The liabilities of a bank are its deposits. The assets of a bank include its loans, its ownership of bonds, and its reserves (which are non loaned out). The net worth of a bank is calculated by subtracting the banking company's liabilities from its avails. Banks run a gamble of negative internet worth if the value of their avails declines. The value of assets can pass up because of an unexpectedly loftier number of defaults on loans, or if interest rates ascension and the bank suffers an asset-liability time mismatch in which the bank is receiving a depression rate of involvement on its long-term loans merely must pay the currently college marketplace rate of interest to concenter depositors. Banks can protect themselves against these risks by choosing to diversify their loans or to hold a greater proportion of their assets in bonds and reserves. If banks concord merely a fraction of their deposits as reserves, so the process of banks' lending money, those loans being re-deposited in banks, and the banks making additional loans will create coin in the economy.

Self-Cheque Questions

Explain why the money listed nether assets on a bank residue canvass may not really exist in the bank?

Review Questions

- Why is a banking concern chosen a financial intermediary?

- What does a balance canvas show?

- What are the assets of a bank? What are its liabilities?

- How do yous calculate the net worth of a bank?

- How can a bank terminate up with negative internet worth?

- What is the nugget-liability fourth dimension mismatch that all banks face?

- What is the risk if a bank does not diversify its loans?

Critical Thinking Questions

Explain the deviation between how yous would characterize bank deposits and loans equally assets and liabilities on your own personal balance canvas and how a banking concern would narrate deposits and loans as avails and liabilities on its balance sheet.

Problems

A banking company has deposits of $400. It holds reserves of $50. It has purchased authorities bonds worth $70. Information technology has made loans of $500. Set up a T-account rest sheet for the bank, with avails and liabilities, and summate the bank'south net worth.

References

Credit Union National Association. 2014. "Monthly Credit Union Estimates." Concluding accessed March 4, 2015. http://www.cuna.org/Research-And-Strategy/Credit-Union-Data-And-Statistics/.

Dallas Federal Reserve. 2013. "Ending `Too Large To Fail': A Proposal for Reform Before It'southward Too Belatedly". Accessed March 4, 2015. http://world wide web.dallasfed.org/news/speeches/fisher/2013/fs130116.cfm.

Richard W. Fisher. "Ending 'As well Big to Neglect': A Proposal for Reform Before It's Too Late (With Reference to Patrick Henry, Complexity and Reality) Remarks before the Committee for the Democracy, Washington, D.C. Dallas Federal Reserve. January 16, 2013.

"Commercial Banks in the U.Due south." Federal Reserve Bank of St. Louis. Accessed Nov 2013. http://research.stlouisfed.org/fred2/series/USNUM.

Glossary

- asset

- item of value owned past a firm or an private

- nugget–liability time mismatch

- a bank's liabilities tin be withdrawn in the short term while its assets are repaid in the long term

- rest sheet

- an accounting tool that lists assets and liabilities

- bank uppercase

- a banking company'south cyberspace worth

- depository institution

- institution that accepts money deposits then uses these to make loans

- diversify

- making loans or investments with a diversity of firms, to reduce the adventure of being adversely afflicted past events at one or a few firms

- financial intermediary

- an institution that operates betwixt a saver with fiscal assets to invest and an entity who will borrow those assets and pay a charge per unit of return

- liability

- any corporeality or debt owed by a firm or an individual

- net worth

- the excess of the asset value over and in a higher place the amount of the liability; total assets minus total liabilities

- payment system

- helps an economy substitution goods and services for money or other financial avails

- reserves

- funds that a bank keeps on hand and that are not loaned out or invested in bonds

- T-business relationship

- a rest sheet with a 2-cavalcade format, with the T-shape formed past the vertical line down the middle and the horizontal line under the column headings for "Assets" and "Liabilities"

- transaction costs

- the costs associated with finding a lender or a borrower for coin

Solutions

Answers to Cocky-Check Questions

A bank's assets include cash held in their vaults, simply assets likewise include monies that the banking company holds at the Federal Reserve Banking company (called "reserves"), loans that are made to customers, and bonds.

Source: https://opentextbc.ca/principlesofeconomics/chapter/27-3-the-role-of-banks/

Posted by: yoderhadegre.blogspot.com

0 Response to "Who Do Banks Loan Most Of Their Money To"

Post a Comment